[ad_1]

The company being investigated for attempting to sell Graceland did not file a single required document with the local deeds office to show that it has any rights to Elvis Presley’s Memphis estate — but it was still able to proceed with its foreclosure sale plan because of a system that leaves such battles up to the courts to decide, according to county officials and a foreclosure lawyer.

Naussany Investments & Private Lending, a creditor with no internet footprint, claims it gave Lisa Marie Presley, Elvis Presley’s daughter, who died last year, a $3.8 million loan, with a deed of trust on the compound pledged as collateral.

But there are no records of such a transaction, according to Willie Brooks, the Shelby County register of deeds, and Vincent Clark, an administrator at the Shelby County Register of Deeds Office.

“They have filed nothing in our office, not even for anything other than Graceland. So we’ve never heard of this company before either,” Clark said.

For one, Naussany Investments should have requested a quit claim form, the standard legal document used to transfer real estate ownership, but it did not, Brooks said. The company should have also filed a substitute trustees deed, the first step in foreclosing on a property, which lays out who the company has assigned to manage the foreclosure and provides the company with an identification number, but it did not.

A lien is also typically placed on a property in loan cases, but that also was not done. And while filing a mortgage would have legally and publicly documented the transaction, bolstering the company’s claim that it took place, the company failed to do so.

“It is kind of odd,” Clark said. “Usually title companies and mortgage companies are very particular that stuff be on public record and filed in our office.”

On Thursday, Tennessee Attorney General Jonathan Skrmetti announced he would look into Nausanny Investments’ attempt to foreclose on Graceland and determine the “full extent of any misconduct that may have occurred.”

“Graceland is one of the most iconic landmarks in the State of Tennessee, and the Presley family have generously shared it with the world since Elvis’s passing,” Skrmetti said in a statement. “My office has fought fraud against homeowners for decades, and there is no home in Tennessee more beloved than Graceland.”

Despite not filing the required documents with the deeds office, the company was allowed to continue with its plan to foreclose on Graceland, posting public notices of its plan earlier this month, due to a system designed to have contested cases stopped in court.

“They essentially leave it up to the civil authorities in a court setting to contest something like what has happened with Graceland,” Clark said. “There’s not a whole lot in place to stop something like this.”

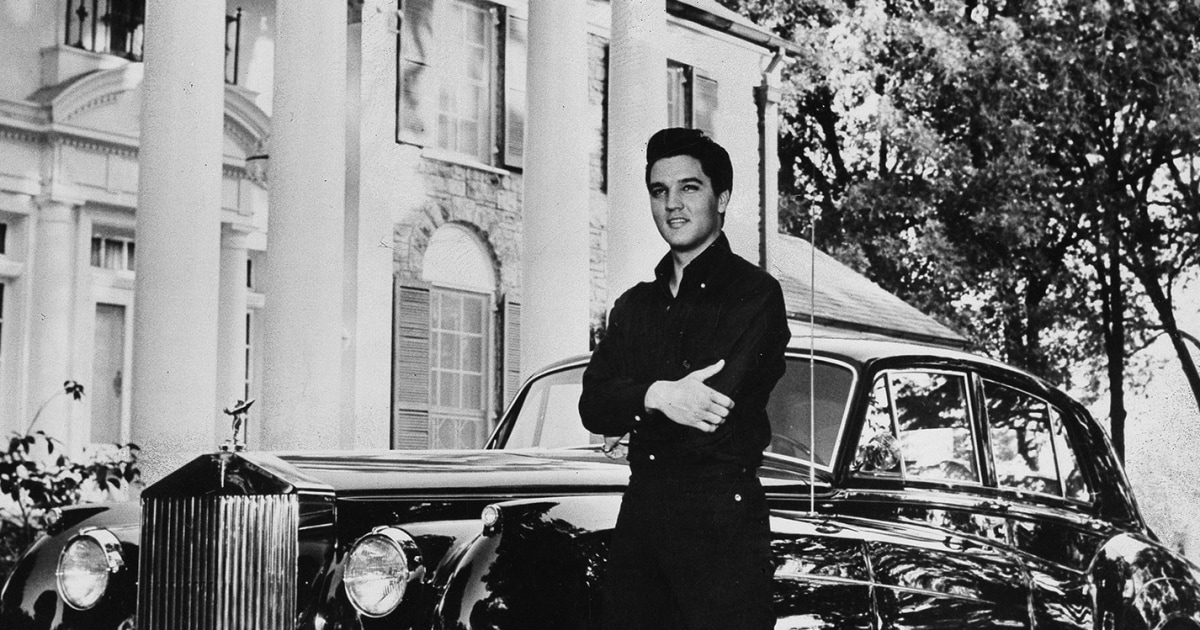

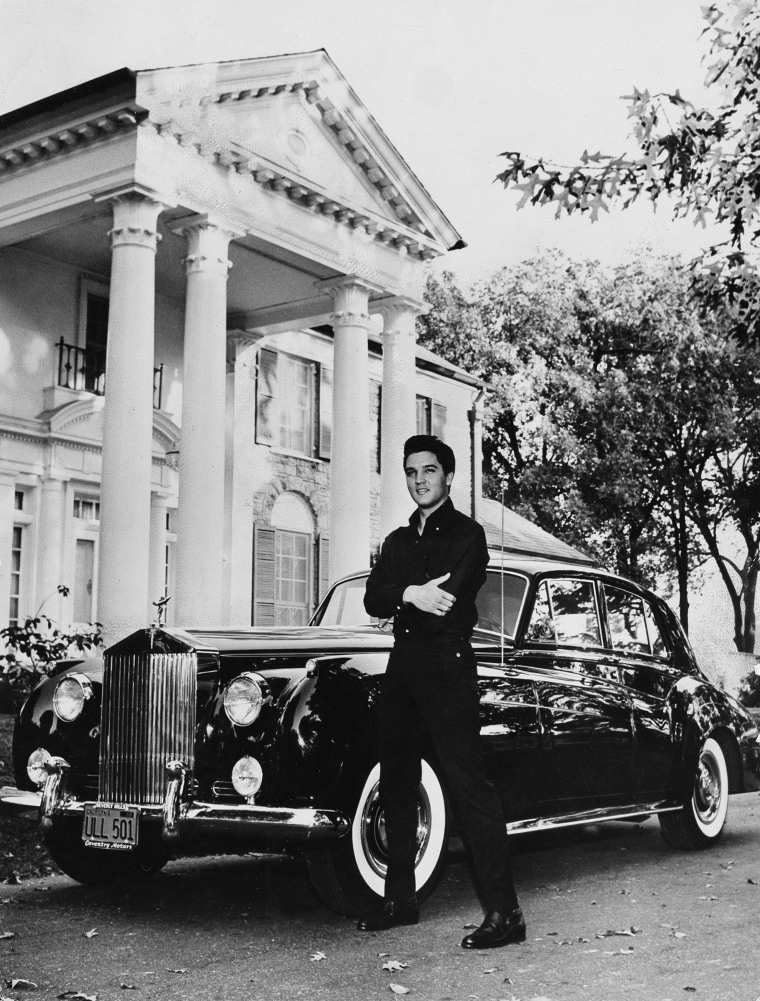

Elvis Presley’s granddaughter, actor Riley Keough, turned to the courts. Her lawyer asked a judge on Wednesday to stop Naussany Investments from selling Graceland, which has been in the family’s control since Presley bought it in 1957.

Keough filed a claim last week in Shelby County Chancery Court in Tennessee alleging that Naussany Investments had submitted fraudulent documents with forged signatures showing Lisa Marie Presley had put up Graceland to secure the loan. The foreclosure sale was scheduled for Thursday. Keough said in the court filing that Presley never borrowed money from Naussany Investments or gave it a deed of trust.

On Wednesday, Chancery Court Chancellor JoeDae Jenkins, who is presiding over the court case, delayed the sale and told Keough’s lawyer, Jeff Germany, that she will most likely succeed in blocking it for good.

“It appears that you, Mr. Germany, your client will be successful on the merits,” Jenkins said, “providing that you prove the fraud that has been alleged.”

A representative for Naussany Investments wasn’t in the courtroom, adding to the mystery shrouding the self-described lender.

NBC News has searched multiple public records databases for any person in the U.S. with the last name Naussany and for any company with the name Naussany or the initials NIPL and found nothing. NBC News also couldn’t find any social media profiles belonging to the company or its representatives.

On Tuesday night, the Shelby County court received a faxed response to Keough’s claim from Gregory E. Naussany that described him as a lender with the company. The filing denied Keough’s accusation and asked that the company be allowed to continue with the sale.

“I respectfully deny the allegations made by Danielle Riley Keough,” Naussany wrote to the court, using the actor’s real name. “Naussany Investments & Private Lending is prepared to provide evidence and arguments to demonstrate the relief sought is not justified in this case.”

The filing included a phone number and an email address for Gregory E. Naussany. No one picked up the phone or responded to texts sent to that number. But a request for comment to the email address Wednesday drew a response indicating that the company would drop the case after “consultation with lawyers.”

NBC News replied, asking for more information about him and the company and an explanation for why there is no publicly available information about them. NBC News also asked to speak with him by phone. A response signed “Gregory E Naussany” declined, saying more information would come in a future court document. “It’s apparent that Keough and LMP family was not aware of LMP mishandling of money and finances,” the reply said, using Lisa Marie Presley’s initials.

NBC News reached out for additional comment Thursday but did not receive an immediate response.

There were no new filings on Thursday. Tracy Askew, the operations manager for the Chancery Court Clerk’s Office, said it’s unclear if Naussany has dropped the case. “I don’t see any new hearing date set on this case at this time,” Askew said.

When asked how the case went further despite the lack of required filings, Brooks, the register of deeds, said it’s outside of the jurisdiction of his office. “We’re not in line with those transactions, so we’re not able to validate anything that occurred with that property. Nor are we able to validate that a loan was taken,” he said.

In Shelby County, Brooks said, cases of quit claim fraud — when somebody claims they own a property that they do not — is prevalent, and most of the victims are elderly people. In some cases, the victims are deceased.

Brooks said most cases are handled in civil court. He said there were about 60 such cases of fraud in 2023 and about 400 cases since about 2018.

Darryl Castle, a Memphis lawyer who represents people facing foreclosure, said fraudulent foreclosures rarely are successful because the court stops them.

When someone is the subject of a proposed foreclosure, they must be given notice, and that gives the person a chance to challenge the foreclosure in court, Castle said. If a foreclosure is challenged, the court requires the person filing the foreclosure to prove they have a right to the debt.

That means having the proper documents filed with the court. In the Graceland case, in which there appears to be no proper documents, the attempt was halted in court, Castle said.

“My opinion is that the system is working,” Castle said. “If the system didn’t work you wouldn’t have heard about any of this.”