[ad_1]

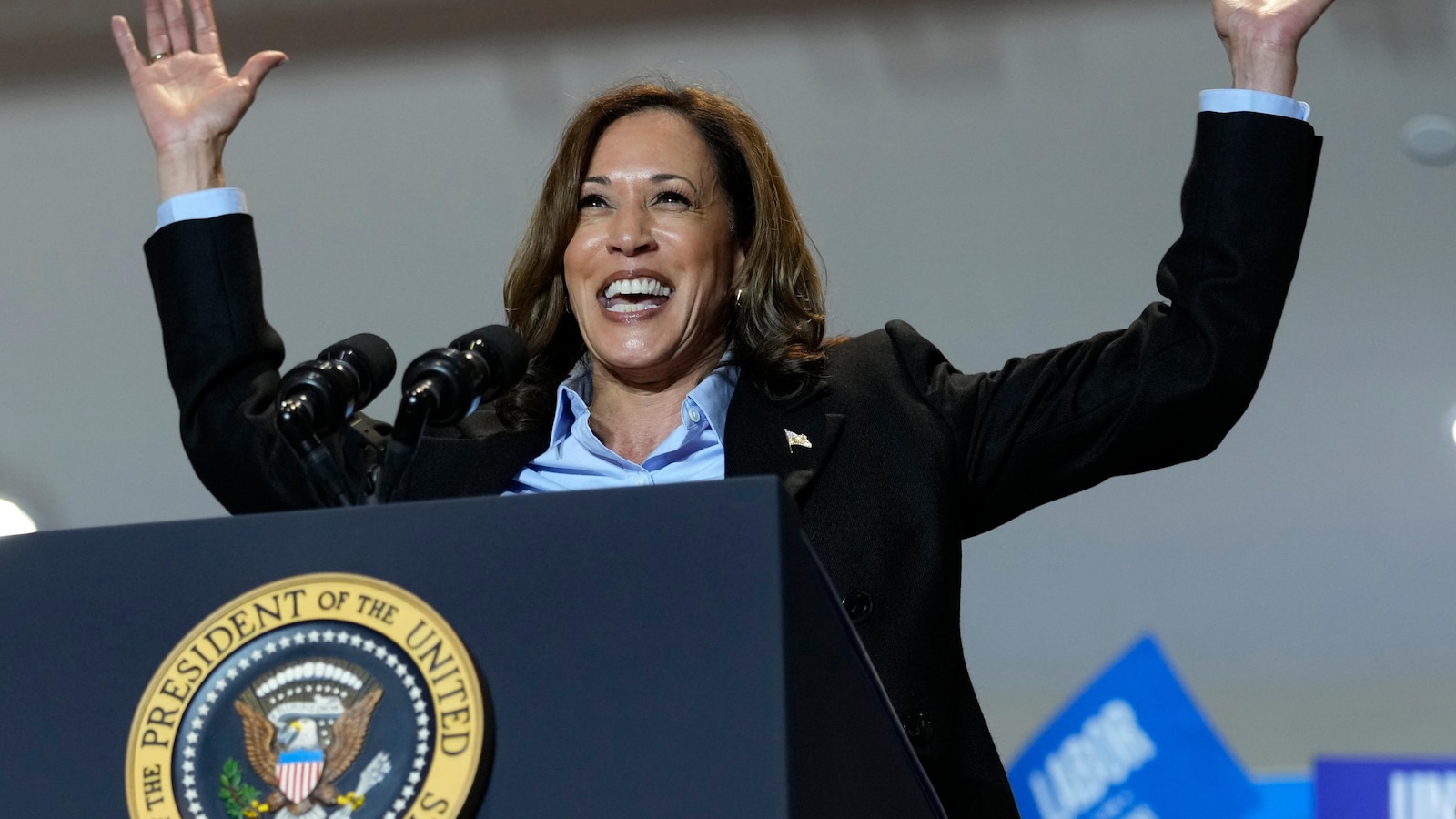

WASHINGTON — Vice President Kamala Harris is using a New Hampshire campaign stop on Wednesday to propose an expansion of tax incentives for small businesses — presenting a pro-entrepreneur plan that may soften her previous calls for wealthy Americans and large corporations to pay higher taxes.

She wants to expand from $5,000 to $50,000 tax incentives for small business startup expenses, with the goal of eventually spurring 25 million new small business applications over four years. Harris is making the announcement while visiting the Portsmouth area, across the Piscataqua River from Maine.

New Hampshire has been reliably blue in recent presidential elections, but the trip could also have some benefit across state lines since Maine splits its electoral votes, allowing candidates to win some without carrying the full state. Still, it marks a rare deviation from Harris spending most of her time visiting a tight group of Midwest and Sun Belt battlegrounds likely to decide November’s election.

Since President Joe Biden dropped his reelection bid and endorsed Harris, the vice president has focused on the “ blue wall ” states of Michigan, Wisconsin and Pennsylvania that have been the centerpiece of successful Democratic campaigns.

She’s also frequently visited Arizona, Nevada and Georgia, all of which Biden narrowly won in 2020, and North Carolina, which she’s still hoping to flip from Republican former President Donald Trump.

Wednesday’s stop comes after Harris marked Labor Day with Monday rallies in Detroit and Pittsburgh and before she heads back to Pittsburgh on Friday — marking her 10th visit to Pennsylvania in 2024. By contrast, Wednesday is her first visit to New Hampshire in years.

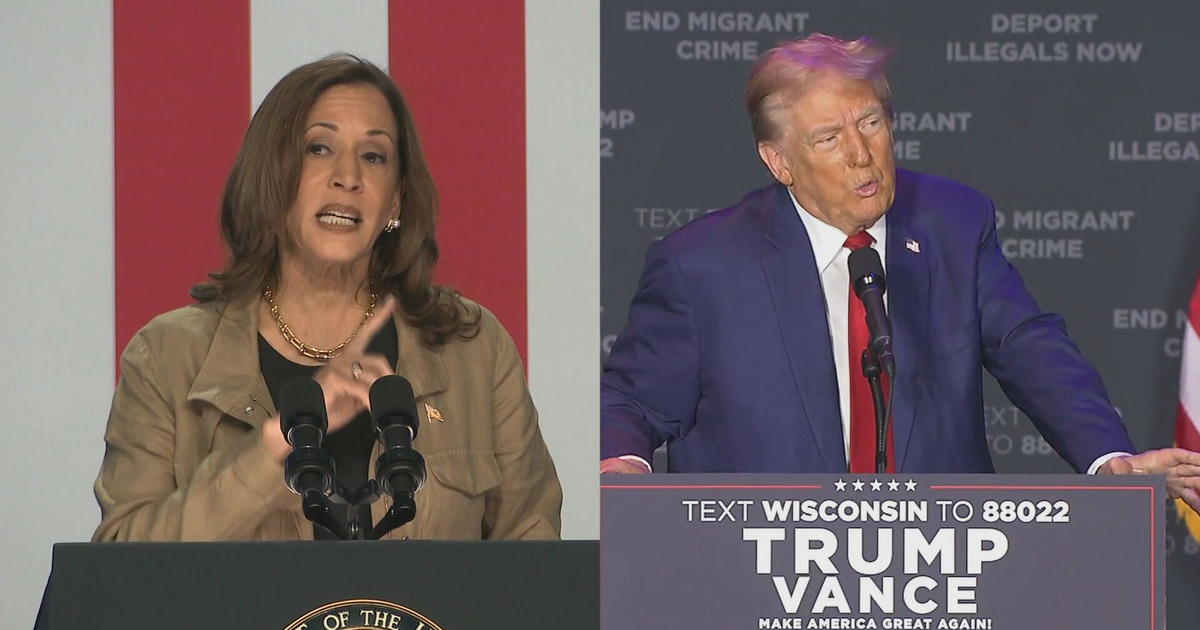

Trump has called for lowering the corporate tax rate to 15% — a break with Biden who in his budget proposal in March suggested setting the corporate tax rate at 28%. Harris has released relatively few major policy proposals in the roughly six weeks since taking over the top of the Democratic ticket, but has not suggested she’s planning to deviate greatly from his administration on tax policy.

The small business plan Harris is presenting Wednesday has lots of facets that many in the business community would like. But that contrasts another proposal Harris unveiled last month, where she promised to help fight inflation by working to combat “price gouging” from food producers that she suggests have driven grocery store prices up unnecessarily.

Harris has built her campaign around calls to grow and strengthen the nation’s middle class — and suggested that rich Americans and large corporations should “pay their fair share” in higher taxes.

Biden, who similarly built his campaign around promoting the middle class, won New Hampshire by 7 percentage points in 2020, but Trump came much closer to winning it against Hillary Clinton in 2016. Still, the Harris campaign notes that it has 17 field offices operating in coordination with the state Democratic party across New Hampshire, compared to one for Trump’s campaign.

Some of the state’s Democrats were angry that Biden directed the Democratic National Committee to make South Carolina the first state to vote in the party’s presidential primary this year — displacing Iowa’s caucus and a first-in-the-nation primary New Hampshire held for more than a century.

Despite that, New Hampshire pressed ahead with an unsanctioned primary. Though Biden didn’t campaign in it, or appear on the ballot, he still easily won via a write-in drive.

Trump is nonetheless hoping to use what happened to his advantage, posting on his social media account that Harris “sees there are problems for her campaign in New Hampshire because of the fact that they disrespected it in their primary and never showed up.”

“Additionally, the cost of living in New Hampshire is through the roof, their energy bills are some of highest in the country, and their housing market is the most unaffordable in history,” the former president wrote. “I protected New Hampshire’s First-In-The-Nation Primary and ALWAYS will.”