[ad_1]

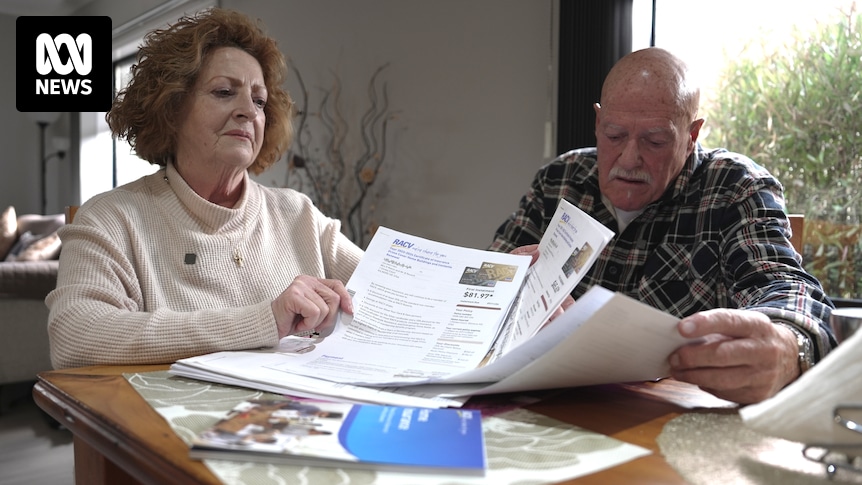

A framed photo with NRL legend Billy Slater takes pride of place in Kerry Reece’s living room.

She’s been a devoted Melbourne Storm supporter since his premiership glory days at the club.

But that same instinct for loyalty hasn’t always served her well.

Kerry kept her home insurance with the one company for decades, figuring “You stay loyal because you think they’re going to be loyal to you”.

As her premiums rose and the cost of living began to bite, Ms Reece found herself cutting back on small luxuries.

“We don’t go anywhere,” she said.

“I can’t tell you the last time we went to a movie. I think it was Titanic.”

Now a lawsuit filed against the insurance giant IAG is alleging the company deliberately targeted customers like Ms Reece — specifically because they were loyal.

The central claim is that a computer algorithm was used to inflate premiums for customers considered more likely to stay, a practice dubbed “loyalty uplift”.

Those increases may have had nothing to do with the person’s risk profile or the cost of providing the insurance.

Customers likely to leave were allegedly given smaller premium increases than those who were expected to stay.

Ben Hardwick from law firm Slater and Gordon suspects millions of customers could have been badly misled.

“They were [allegedly] giving them a discount for their loyalty when in fact that discount was meaningless.

“The insurance company was jacking up the base premium before the discount was applied, with the effect the discount really had no value at all,” Mr Hardwick said.

Class action alleges insurer misconduct

On its website Insurance Australia Group (IAG) says it is the largest general insurance company in Australia and New Zealand and its best-known brands include NRMA and CGU.

IAG’s insurance profits sit at more than $800 million — a jump of almost 40 per cent in the last financial year.

The lawsuit alleges IAG customers in Victoria, Western Australia, and South Australia were systematically misled about their home and contents insurance over the six years to 2024.

The insurance brands involved in the alleged misconduct are the Royal Automobile Club of Victoria (RACV), the State Government Insurance Office (SGIO) in Western Australia, and the State Government Insurance Commission (SGIC) in South Australia.

It involves two subsidiary companies Insurance Australia Limited and Insurance Manufacturers of Australia, which is 70 per cent owned by IAG and 30 per cent by RACV.

Slater and Gordon is also investigating a possible class action involving NRMA customers.

‘A kick in the guts’

Ms Reece first became an RACV member in 1984.

Her recent renewal notice said she has “gold membership” status, which entitled her to a 15 per cent discount, a multi-policy discount, and a no-claim bonus equating to hundreds of dollars in savings.

She was shocked by the allegations her insurer used a “loyalty uplift,” on some customers.

It is unclear if she was personally affected.

“I think it’s disgusting,” she said.

“It was a kick in the guts, it just made me feel sick.”

Mr Hardwick said his firm would seek to prove customers were misled about pricing discounts, which meant in some cases they weren’t actually receiving cheaper insurance.

“We believe that many of those people could be entitled to over $1,000 in compensation (each),” he said.

IAG is also being sued by the corporate cop, ASIC, over allegations it misled home insurance customers about the loyalty discounts they received involving the same insurance brands.

However, IAG denied the allegations and is defending the case.

Customers denied an ‘informed choice’

Slater and Gordon says the insurance giant was in breach of the industry code and misused its dominant position against its customers.

“If these customers had known the full story, they could have made an assessment, “Should I shop around and go to another insurance company?”

“But these customers were duped, they were getting their renewal notices each year and those notices were saying, “You’re a loyal customer, I’m going to give you a reward for that”.” Mr Hardwick said.

The lawsuit says the insurance giant broke the law by engaging in misleading and deceptive conduct and what’s known as unconscionable conduct.

Jeannie Paterson, an expert in consumer law from Melbourne University said insurer conduct was “murky territory”, and there was considerable uncertainty about exactly what unconscionable conduct means.

It could include a company taking advantage of unequal bargaining power including unequal access to information, and failing to take into account the interests of consumers, especially if some of those consumers were at “a special disadvantage”.

“(A special disadvantage is) a customer who is obviously acting under language constraints, understanding constraints, emotional constraints, charging that person an exorbitant price when that person is clearly unable to make a decision in their own best interest is a classic case of unconscionable conduct,” Professor Paterson said.

Insurance Australia Group told the ABC in a statement: “We are dedicated to providing the best possible service and support for our customers.”

“The Class Action … relates to the allegations in the ASIC legal proceedings filed in August last year about SGIO, SGIC and RACV home insurance products. We are defending those proceedings.”

“We maintain we have delivered on loyalty promises made to customers and will also defend this Class Action.”

It has denied the allegations made in the ASIC lawsuit — including that computer modelling was used to deprive customers of the full benefit of loyalty discounts.

In a submission to that case, it has also rebuked the suggestion consumers were harmed.

“ASIC has not identified any customer who allegedly paid a higher premium by reason of the demand modelling,” the submission said.

The ABC contacted IAG about the class action and it is yet to respond.

ASIC has been increasingly active in monitoring insurer conduct.

In a report from June last year, the regulator said IAG would repay $447.2 million to 4.25 million customers for pricing failures since 2018.

In total, the sector was forced to refund more than $815 million for overcharging.

Class actions can play an important role in holding corporations accountable for illegal conduct because while the cost of litigation is too high for most individuals to consider — it can make sense as a group, according to Professor Paterson.

“In that sense, they’re really effective and part of the toolkit for enforcing important law that’s supposed to protect individuals.”

However, class actions can result in lengthy, costly court battles, and proving the financial harm can be difficult.

Some people wind up disappointed by the amount they receive after a settlement.

“Consumers often feel a moral outrage that they’ve been misled or taken advantage of and unfortunately, that’s not what the law compensates,” Professor Paterson said.

Ms Reece and her husband will be watching the case closely.

Their house and vehicle remain insured with RACV.

The lawsuit has made them question if their loyalty has been exploited.

“If I had known (then) when it was coming up for renewal every year, I would have definitely gone on the phone and shopped around,” she said.

Loading…