[ad_1]

The government has released its 2024 budget, with the Stage 3 tax cut revisions being the main cost of living relief measure.

The changes to the tax cuts passed parliament in February and will come into effect on July 1.

All Australian taxpayers who earn above the tax-free threshold, which is set at $18,200, will receive a tax cut.

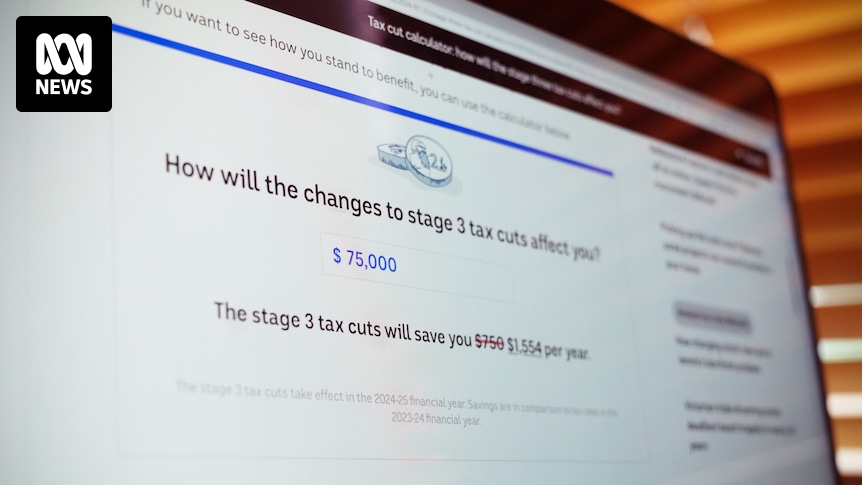

Use the calculator below to work out how much you will save under the stage 3 tax cut changes.

What are the new tax brackets?

The tax brackets have been changed to the following:

- Earn up to $18,200 – pay no tax

- Pay a 16 per cent tax rate on each dollar earned between $18,201-$45,000

- Pay a 30 per cent tax rate on each dollar earned between $45,001-$135,000

- Pay a 37 per cent tax rate on each dollar earned between $135,001 — $190,000

- Pay a 45 per cent tax rate on each dollar earned above $190,000

What were they going to be?

The previous plan would have introduced tax cuts in July that would provide the largest benefit to high-income workers and a smaller benefit for middle-income workers:

Earn up to $18,200 – pay no tax

Pay a 19 per cent tax rate on each dollar earned between $18,201-$45,000

Pay a 30 per cent tax rate on each dollar earned between $45,001-$200,000

Pay a 45 per cent tax rate on each dollar earned above $200,000

Loading…

Posted