[ad_1]

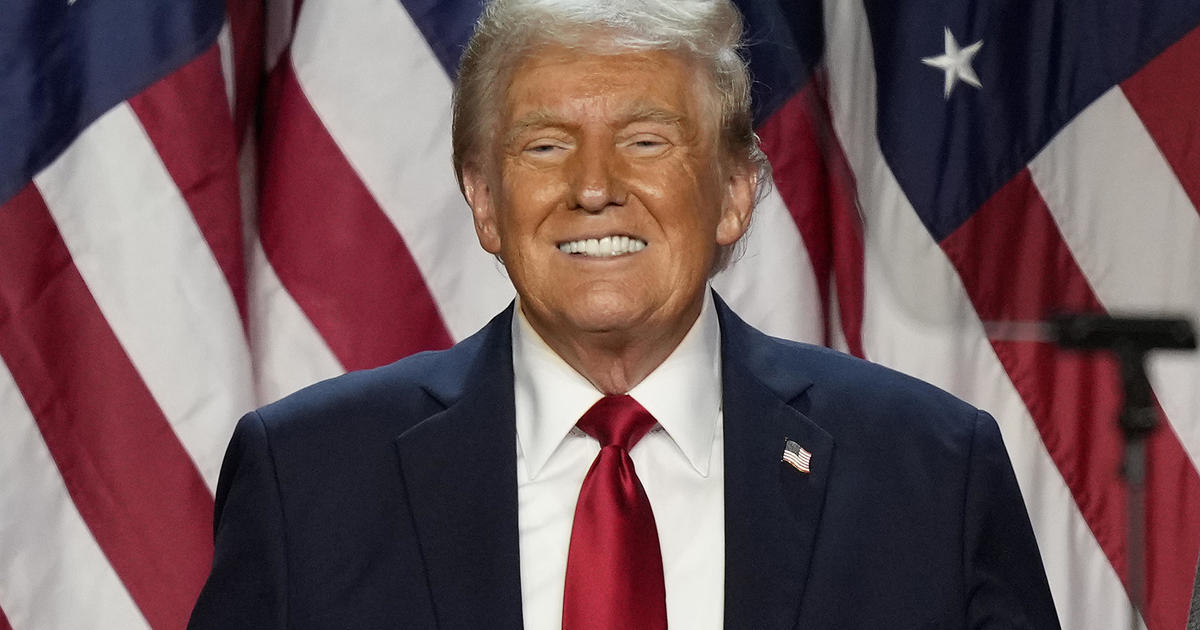

Stocks and other financial assets are surging after Donald Trump was projected as the winner of the U.S. presidential election and the Republican party gained control of the Senate.

The Dow Jones Industrial Average shot up more than 1,200 points, or nearly 3%, in early trading Wednesday, while the broader S&P 500 and tech-heavy Nasdaq Composite each gained more than 2%.

Many investors expect Trump’s victory to lead to faster economic growth and more market-friendly policies.

“The markets are scrambling to figure out what happens next, but for the time being, the market is pricing in a higher growth and higher inflation outlook,” Peter Esho of Esho Capital said.

The price of bitcoin jumped nearly 8% to a record $75,345 before falling back slightly. Trump pledged support for cryptocurrencies during the campaign. Shares of the crypto exchange Coinbase rose 18% and almost all cryptocurrencies surged higher, including dogecoin, which jumped 17%.

Bank stocks, which could benefit from less restrictive regulations, rose in premarket trading. JPMorgan, the world’s biggest bank by assets, gained nearly 7%. Capital One rose 11.3%.

Tesla, led by Trump supporter Elon Musk, jumped nearly 13%. The company’s size gives it a big advantage in the electric vehicle market if, as expected, Trump does away with rebates and tax incentives for electric vehicles, according to Wedbush analyst Dan Ives. Shares of Tesla’s competitors largely fell.

Trump is likely to undo some of the Biden administration’s effort to fight climate change. Renewable energy stocks such as First Solar and Enphase were down by double-digits in premarket trading. First Solar has been a big beneficiary of the Biden administration’s Inflation Reduction Act.

Ryan Sweet, chief U.S. economist at Oxford Economics, expects a Republican-led Congress to extend personal tax cuts passed in 2017 during the first Trump administration, while also pushing up federal spending. President-elect Trump is also likely to use “his presidential powers to reduce immigration and impose targeted tariffs on China, Mexico, Canada and the European Union,” Sweet told investors in a report.

Trump has vowed to sharply raise tariffs on imports from China and other countries, darkening the outlook for Chinese exporters at a time when Beijing has relied heavily on ramping up manufacturing to try to revive its slowing economy.

Trump Media & Technology Group, the company behind the former president’s Truth Social platform, spiked 36% overnight as it became increasingly evident that Trump was returning to the highest elected office in the U.S.

“Undoubtedly, we are seeing a clear consensus among investors that President Trump would herald higher Federal Reserve rates, weaker global growth and greater geopolitical uncertainty, all of which is bullish for the dollar,” said Matthew Ryan, head of Market Strategy at the global financial services firm Ebury.

The broad U.S. stock market has historically tended to rise regardless of which party wins the White House, even if each party’s policies can help and hurt different industries’ profits.

The S&P 500 has risen nearly 70% since the 2020 election brought President Joe Biden into office. It rallied to records as the U.S. economy bounced back from the COVID-19 pandemic and managed to avoid a recession despite a jump in inflation.

The economy was a key issue for inflation-weary U.S. voters who chose Trump this time around, though mainstream economists have said Trump’s policy proposals would make inflation worse.

contributed to this report.