[ad_1]

The federal government is releasing its budget tonight.

And while this will inevitably involve a lot of political talk, it will also either directly or indirectly affect your finances.

Here’s why it matters, what to expect and what it could mean for you.

What is the federal budget?

In very simple terms, it’s the federal government’s plan for how it’ll collect and spend money in the coming financial year.

And this plan will impact your financial situation in one way or another, so it’s quite important.

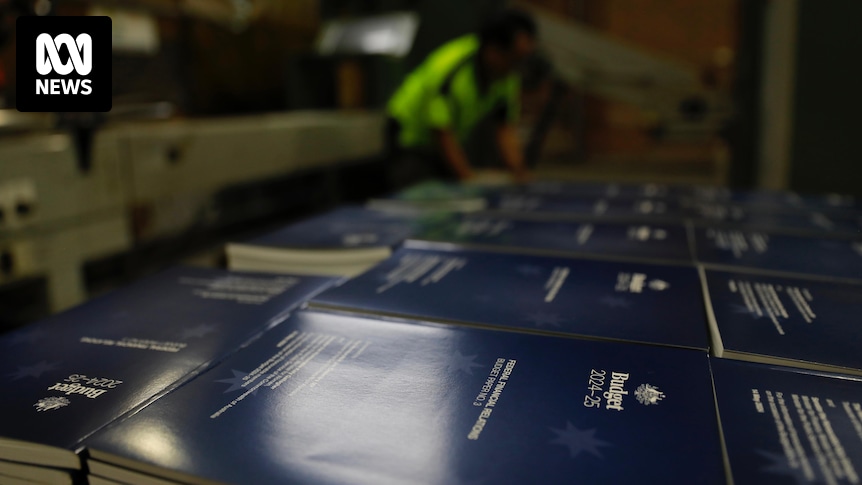

The government details this plan in a set of documents called the budget papers, which are hundreds of pages long and will be up for public viewing tonight.

Before the papers are officially published, the treasurer – a position currently held by Jim Chalmers – makes a speech in parliament summarising the plan.

It’s a long speech, typically taking about half an hour.

And, generally speaking, these speeches talk up the positive points the government of the day wants to promote and gloss over the negatives.

That’s why we have a team of journalists who will be combing through the nitty-gritty details of the budget papers to suss out the real-world impacts of these plans.

What’s in this year’s budget?

Mr Chalmers has used words such as “sensible” and “responsible” to describe the new budget, saying there are no “slash and burn” cuts but there is also no spending “free-for-all”.

Here are a few things we know about the budget already:

- Student debt changes: The federal government wants to change how tertiary education loans are indexed, proposing a backdated scheme that would reduce the amount debts increased by and see some students get refunds from what they paid last year

- Short-term cost-of-living relief: Mr Chalmers says some cost-of-living relief is coming but he hasn’t gone into detail about it yet. He says it “won’t be identical to what we’ve seen in the past but it will be substantial”

- Changes to the tax brackets: Dubbed the stage three tax cuts, they are something we’ve known about for months but won’t come into effect until July. Basically, Australia’s tax brackets will change slightly, as will tax rates, benefiting both lower and higher-income earners

What time is the federal budget speech?

The speech is broadcast live from Parliament House in Canberra at:

- 7:30pm AEST: ACT, New South Wales, Queensland, Tasmania and Victoria

- 7pm ACST: Northern Territory and South Australia

- 5:30pm AWST: Western Australia

Where can I watch the federal budget speech?

It’ll be broadcast on free-to-air television on ABC TV as well as on the ABC News Channel.

You can also stream it on ABC iview.

And you can watch the ABC News live stream via the ABC News website by clicking “watch live” at the top of the page.

We’ll also be blogging the whole thing live on the ABC News website, which will have a live stream of the speech at the top of the article.

Where can I read the budget papers?

On the federal government’s 2024-25 budget website.

There’s only a countdown clock on there at the moment, but we’re expecting it to be updated this evening.

How does the federal budget impact me?

The budget shapes how our economy functions so its ripple effects have an impact on all of us whether you’re a taxpayer or not.

But specific measures will impact certain groups of people more than others.

A good way to get a quick glimpse of these impacts is by reading what we call our winners and losers list, which sums up which groups will benefit the most from the new plan. We’ll publish this later this evening.

When is the new financial year?

July 1.

That’s about seven weeks away.

When is tax time?

Not for another seven weeks.

Technically, you can submit your tax return on July 1, but you have more than 17 weeks to do it.

When are tax returns due?

October 31.

But that’s only if you’re doing it yourself.

If you’re going through a tax agent, you have to book you appointment before October 31 — but that doesn’t mean your appointment has to be before October 31.

Loading…