Former President Donald Trump, if elected next to the office of President, will move on in the aftermath of his previous work with spending cuts, import tariffs, and immigration crackdown.

It might not reach the epic level of the 1975 “Thrilla in Manila” heavyweight boxing contest between Muhammad Ali and Joe Frazier, but the rematch is now official: The main presidential contenders both belonging to the Democratic and Republican parties, will be Joe Biden, the president, and the former president Donald Trump in November.

And with that, the stark contrast between two opposing economic philosophies: whether it is highlighted by the government-as-agent strategy of the last three years, such as the one under former president Biden, or a populist, laissez-faire, deregulatory ethos that formed the heart of the Trump economic agenda of 2017, until the advent of the COVID-19 era, there are still conflicts when it comes to economic changes to be implemented.

Biden’s successes and failures are well known by now: the above factors namely, the good state of the labor market, the strong economic growth of the country, and significant investments by the government in specific departments like semiconductor manufacturing and electric vehicles. However, that is not the only woe. In fact, a huge fiscal tolerance by some economists is blamed for the inflation that flared up in the end of 2021 and is only just ebbing down to pre-pandemic levels now. Overall, the voters’ reaction to Biden’s economic plan is lukewarm rather than raving review.

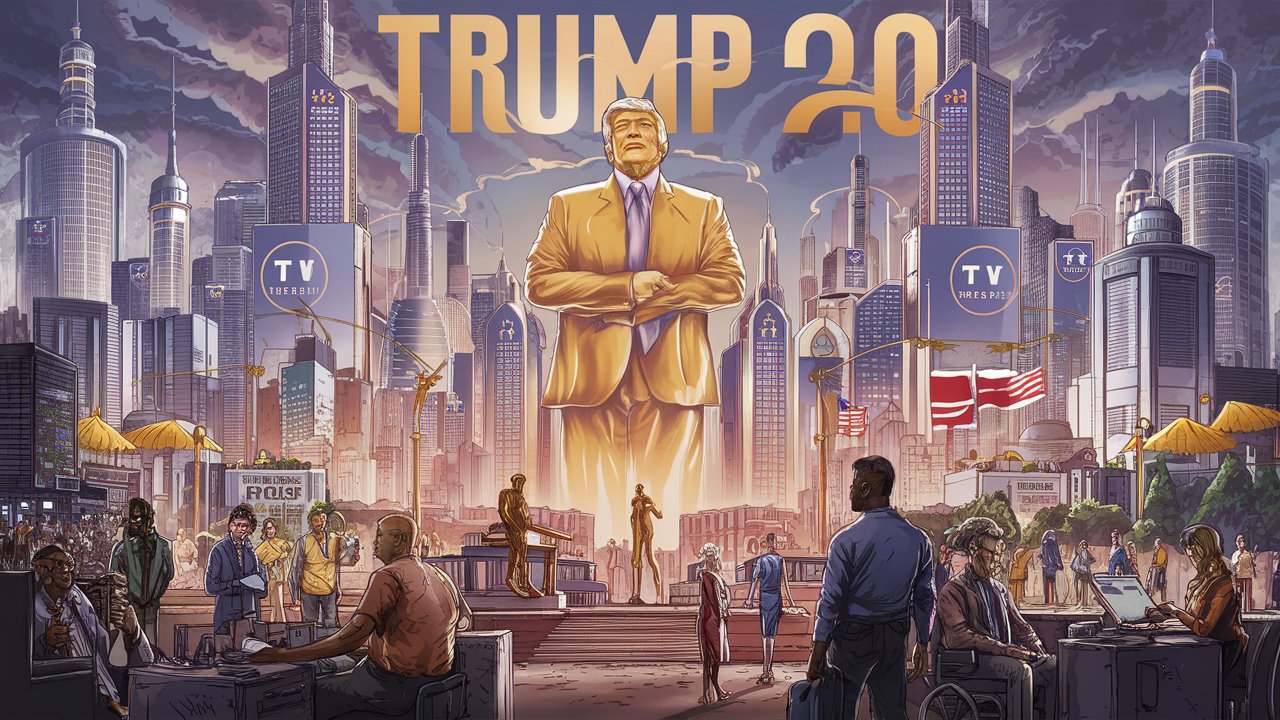

As for Trump, we would like to know what lessons has the former president learned, and whether one will see the same things all over, or if something takes a new turn with the former president’s second term.

In a relatively broad interview with CNBC on Monday, Trump gave the American people an idea of what the next four years might look like if he became the one-seater. In a Trump 1.0 fashion, tariffs as one of the policies will be a feature of it. This, however, will be all the more aggressive. Thrusting thus the proposal likewise shall be the extinction of taxes, a drastic reduction in immigration and much more. Additionally, talk about chipping away existing rights is also mentioned though he himself keeps changing his mind about entitlements.

Import Tariffs

“I’m a big believer in tariffs for two reasons,” Trump told the hosts of the “Squawk Box” morning market show. “Number one, I fully believe in them economically when you’re being taken advantage of by other countries. For instance, China was taking advantage of us on the steel. … They were destroying our entire steel industry, which was never doing very well over 25 years anyway but – you know, because it’s been eaten alive by foreign competition, and they were dumping steel.”

Best Cartoons on the 2024 Election

In the case of Trump, he has proposed tariffs for specific imported items and also a 10% tax on every commodity that will be brought in from other nations. A lot is dependent on the small print and they would probably have to dodge Capitol Hill. However, Trump has often said that China picked up the tabs in the nation’s first tranche of tariffs. Yet a majority of economists across partisan lines maintain that tariffs are taxes on Americans – and some even contend that they raise inflation.

“The tariff, and retaliatory tariffs by other countries, is a matter of concern because it would add costs for goods,” points Patrick Horan, research fellow of the Mercatus Center at George Mason University. “I can only say it is not clear how much the rate of inflation would be affected by this tariff.” Not only will this big tax dent product competitiveness and will drive away customers but also it will harm our producers and consumers.

However, Trump is not tired of such statements, and he kept repeating his familiar line, “They,(_)they are very important to me” sounding in the meantime like the story’s protagonist, Tony Soprano.

At this point, Trump emphasized how his regulations of foreign countries were effective in preventing revenge. “I made them sing,” he said. “I made other counties pay the tariffs.

Kilbane, a general counsel and wealth advisor at Ullmann Wealth Partners Group, notes that “Trump is well known for making statements, following through on certain things he says, and also not following through on many of the things he commits to.”

The elderly man further talks about how instead of always agreeing with the President’s policies, congress sometimes will differ even among fellow Republican Party members.

“Trump had all three, the Senate, the House and the White House” early on in his presidency, yet “even members of his own party voted down repeal of the Affordable Care Act.”

George Calhoun, director of the Quantitative Finance Program at Stevens Institute of Technology, says Trump’s tariffs and other moves already underway in Congress such as the House’s vote this week against TikTok, are “part of the U-turn on China.”

“Sentiment about China has soured so dramatically in the past five years” and is shared by both parties, Calhoun adds.

Immigration Crackdown

The Republican Party has made a cause celebre out of immigration and Trump is no exception. At times during his campaign, he has threatened mass deportations and “ideological screening” of migrants who he has described as “poisoning the blood of our country.”

Such a crackdown could exacerbate what is already a tight labor market as Americans continue to retire at record levels and the birth rate is not sufficient to match the demand for new workers.

“While the federal judiciary – or a Democratic Senate – could conceivably limit his policy options, there is very little chance that immigration will increase from today’s historic levels over the next four years,” Matt Gertken, chief strategist at BCA Research, wrote in a recent analysis of a potential second Trump term. “Labor force growth will slow.”

Alex Nowrasteh, director of immigration studies at the free-market CATO Institute, studied many of the arguments made against immigrants and found many of them lacking.

“Immigrants are typically attracted to growing regions,” he wrote, “and they increase the supply and demand side of the economy once they are there. They expand employment opportunities for everybody.”

Michael Clemens, a nonresident senior fellow at the Peterson Institute for International Economics recently commented on Trump’s proposal.

“The immigrants being targeted for removal are the lifeblood of several parts of the US economy,” he wrote in a post on the institute’s website. “Their deportation will instead prompt US business owners to cut back or start fewer new businesses, in some cases shifting their investments to less labor-intensive technologies and industries, while scaling back production to reflect the loss of consumers for their goods.”

Citing previous research by an economics team at the University of Colorado, Clemens noted that for every 1 million immigrant workers deported from the U.S., 88,000 native U.S. workers lose their jobs.

In his first term, Trump picked on Federal Reserve Chairman Jerome Powell, an Obama appointee, as governor. He was then made chairman by Trump and reappointed by Biden. Trump was upset in 2019 that Powell was not doing enough to lower interest rates and stimulate the economy.

He famously asked whether Powell or Chinese President Xi Jinping was the “bigger enemy” of America. In February, Trump told Fox Business News host Maria Bartiromo he would not reappoint Powell if he wins the White House again.

Although the Fed is avowedly nonpolitical, some fear that Trump might choose a friend or political associate to the powerful post of chairman should a vacancy occur. Former Treasury Secretary Steve Mnuchin, one of the Trump Cabinet members who served the former president and kept his reputation intact, is a very successful investor.

Tax Cut Fever

Reducing taxation, mostly for corporations and those with high incomes, is an element that has been a perennial feature of the Republican economy. In the course of 2017, Trump succeeded and won Congress’s approval of the $1.7 trillion tax cut. Tax cuts is often an issue economists discuss but little else is debated when talk of adding to the national debt is brought up if the cuts are not offset with other cuts or revenue enhancement.

It is foreseen that the end of the extension of the Trump tax cuts in 2025 presents Trump with the window of opportunity to take on that situation again. Afterward, cutting taxes turns out to be tough as well. These situations may differ, depending on who presides over the Senate and House. Biden, however, to keep this policy moving, is planning to levy more taxes on the rich.

At the core of the debate is the corporate tax rates. The rate dropped to 21% from 35%, which was a result of the 2017 tax cut law. Sen. Trump has stated that he would like it to remain at that level and ever since V.P. Biden has been asking for it to be raised to 28%.

In an investigation released this week, Allianz Chief Economist Mohamed El-Erian found that the mix of proposals of President Trump would harm the consumers and possibly work as a shock to the market. Many of the exact answers to those questions would have to do with the ways those policies are implemented, it outlined.

“The Trump 2.0 presidency would inherit incredibly big fiscal deficits that were created by the Biden Administration, as well as expenditures on interest and an economy that is having more bouts of inflation. “Another round of big and deficit- bearing tax cuts (or the spending increase) could again ignite inflation and heighten fear of public finances damage in the market.”

According to Maxime Darmet, a senior economist for the U.S and France at Allianz Trade, he expects Trump to pursue tough negotiations in order secure deals, suggesting he will not blockade the process.

One guardrail Darmet sees is the increasing power of the conservative wing of the Republican Party in Congress and its aversion to increased government spending and deficits. He believes Trump may use reversals of some of Biden’s policies in support of green energy and high-tech manufacturing to finance his own industrial policy, which Darmet says would be broader and less targeted than those employed by Biden.

“Even more than Biden, he would unleash industrial subsidies on a whole set of sectors. Pretty much everyone would get a little bit of money,” he says.

But the economic environment has changed so much since he took office in 2017 – notably interest rates that are four to five times higher.

“There are a lot of constraints now,” he says. But, if enacted, “we think his policies might be more inflationary.”

One plausible outcome of the election could be a president of one party, Biden or Trump, and a split Congress. Divisions within the GOP could also present a problem, as former Speaker Kevin McCarthy found out when he tried to make deals with Democrats to keep the government running.

“History has shown our government works best when it’s divided,” Kilbane says.